After you sign up for a home loan, a loan provider will wanted an appraisal of the home, whether you are to order a house or refinancing mortgage.

What exactly is a home assessment?

A home assessment are an authorized or official appraiser’s view off a beneficial house’s worth. New assessment will be based upon research of the latest conversion out of similar home in payday loan Cope your community, a diagnosis of the property and also the appraiser’s view.

The property serves as equity when your borrower defaults, and so the lender really wants to ensure that the mortgage isn’t really too larger, compared with the fresh new property’s worth.

Domestic examination vs. appraisal

A home evaluation is actually for comparing a great house’s status. The inspector walks thanks to and you can monitors the structure regarding most useful to help you bottom, like the walls, ceilings, flooring, doors and windows, while the technical and you will electronic expertise, devices and you will plumbing work. Once considering that which you the fresh inspector will bring a target declaration, as well as repair guidance.

An assessment try an assessment away from domestic value. The new appraiser considers brand new house’s updates within the study from just how much the property is definitely worth, as well as other facts, like the regional housing market. This new appraiser cannot make ideas for solutions.

Family appraisal pricing

A house appraisal generally speaking will cost you from the $3 hundred to help you $eight hundred – having a national average regarding $336, according to HomeAdvisor. Charge differ by particular loan. The brand new Virtual assistant mortgage program have a-flat plan to own assessment charges. FHA assessment charge are very different by area and you can size of your house.

While the lender commands the fresh new appraisal, the borrowed funds applicant usually covers it a portion of the mortgage’s settlement costs.

Household assessment process

An assessment is frequently needed for a buy otherwise home mortgage refinance loan, many government re-finance apps generally do not require appraisals, including FHA improve, Va rate of interest avoidance home mortgage refinance loan (Virtual assistant IRRRL) and you may USDA streamline fund.

If you find yourself to order a home, the lender tend to purchase the newest assessment once you have produced an offer and finalized a purchase arrangement. Whenever refinancing mortgage, the lending company tend to purchase the new appraisal when you apply.

You could potentially query so you’re able to go with this new appraiser towards the go-courtesy of the property provided it is Okay into the lender, according to Assessment Institute, a professional relationship out-of a home appraisers.

What do domestic appraisers select?

A house appraisers thought of several information to choose good home’s worth. The fresh appraiser will do ine the property. Listed below are some of the items they account for:

Household assessment listing

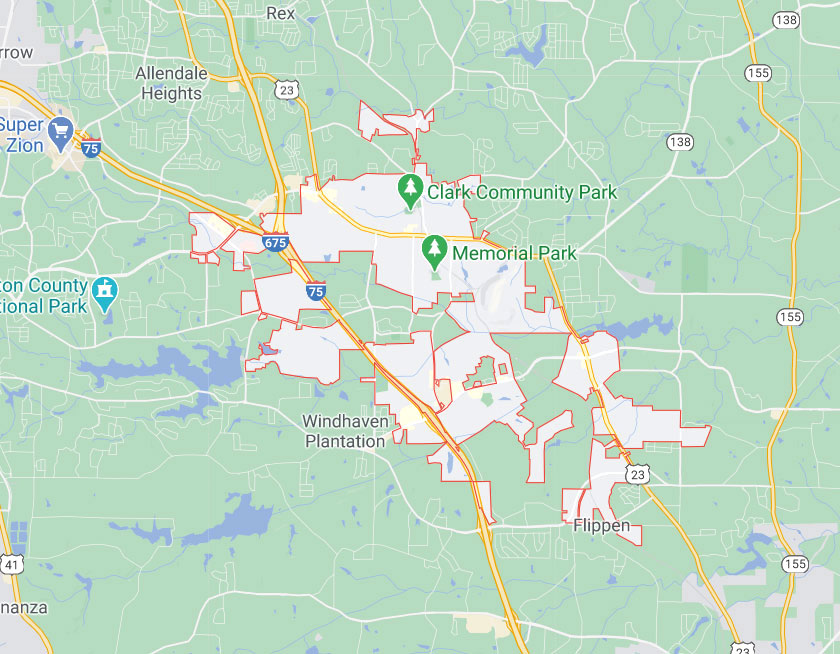

- Society services.

- Regional housing marketplace manner.

- Purchases rates of comparable property has just purchased in the room.

- Package and you may home dimensions.

- Years and you may model of the home.

- Types of indoor and you can exterior information.

- Updates of the house.

- Equipment.

- Amenities, such as for example fireplaces or porches.

- Renovations and you may home improvements.

Bringing a home assessment report

Because the mortgage borrower, you really have a straight to a free copy of your own assessment statement at least 3 days up until the loan closes. It is best to read through the newest are accountable to identify precision.

Allow financial know if you notice errors and you will consider the new projected really worth was completely wrong. One relevant suggestions you offer you will definitely head this new appraiser in order to reevaluate. It’s also possible to query the lender for the second assessment. Bear in mind you will need to pay money for the fresh assessment when the the newest demand are offered.

In the event your appraised well worth try below questioned on a house we would like to pick, you may be able to utilize that suggestions to negotiate an excellent cheap to the provider.

NerdWallet

This information try lead and provided by Nerdwallet. Nerdwallet provides people and you may smaller businesses clearness around each of life’s monetary choices. When it comes to handmade cards, bank account, mortgages, loans or any other expenditures, consumers generate almost all their conclusion at nighttime. NerdWallet is evolving you to, permitting guide consumers’ choices having free expert posts.