An NRI are an enthusiastic Indian citizen holding an Indian passport but staying in a foreign nation to own an ambiguous months to own no. 1 grounds from:

- A job.

- Company and other vocation.

- Towards the deputation which have around the world organizations, employers or our very own embassies pass on all over the world.

The latest NRI area is offered a host of attributes because of the financial suiting their demands beneath the specifications out-of RBI and you will FERA laws and regulations. Of these, the brand new Relationship Heaven Home loan especially readily available for brand new NRIs was into the high demand. So far as the brand new system goes, it is rather just like the Connection Financial Plan in the have and you can facilities. Yet not, being a beneficial NRI, you’ll have to conform to a lot more paperwork typically relevant inside your instance. At the same time, just be sure to assign an almost bloodstream relative co-candidate and you will the ideal Strength out-of Lawyer within his /their particular like.

Housing Financing to own High-net-well worth Some body

Connection financial lies higher increased exposure of the credit rating therefore will act as the fresh new benchmark to have application of rate of interest since the better once the quantum from mortgage qualification. This kind of an environmentally-program the importance of a high-net-really worth individual can’t be discount. On flipside, there is no specified measure to help you identify who a top-net-worth private try. During the layman’s conditions the person will be categorized as a result if the he has abundant quick assets versus meager debts. Then again, that is bound inside the geographic nations according to savings. Yet not, the lending company will not promote any unique plan in their eyes however, perform admit your have yourself loan products are thus customized the highest-net-individual will certainly get the very best package.

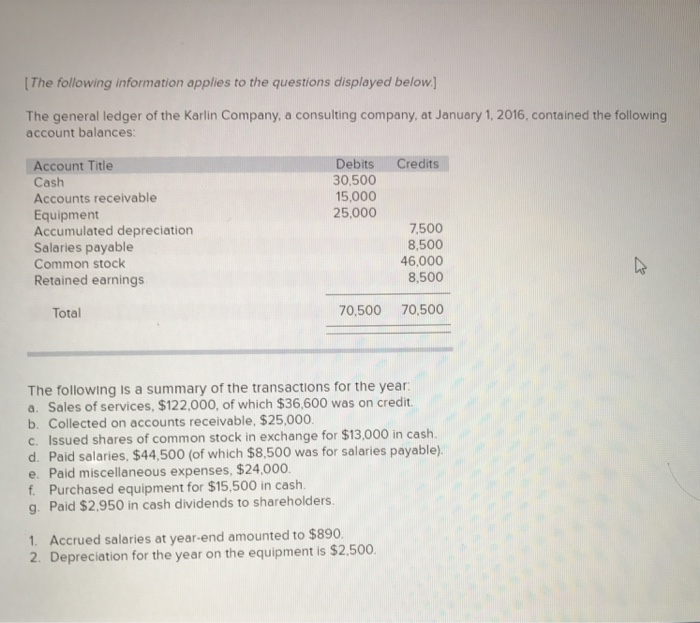

Limit Number of Mortgage permitted within this system

Brand new parameters on UBI to determine the maximum quantum out of financing is actually well-defined of the simple fact that the financial institution even offers good-sized investment out-of 65% to have financing wide variety more than Rs.200L excluding the newest stamp obligation, membership, Tolsona AK payday loans transfer commission and so on. The other factor employed utilizes the fresh installment strength of one’s borrower at the mercy of numerous details within the gamble, but nevertheless there is no defined higher limit.

Union Bank Mortgage to have NRI

This new Partnership Eden Home loan was essentially suited to NRI consumers toward large coverage off demands that it also provides. Yet not, this new NRI has to follow additional documentation within the song having the smoothness out-of his home.

Based upon this new cost capability of debtor and value of, UBI finance up to the second proportion of the enterprise prices.

- 20%: Up to Rs.75L for sale otherwise structure

- 25%: Out of Rs.75L so you’re able to Rs.200L for sale or design

- 35%: Above Rs.200L to buy or framework

Ideas on how to Submit an application for Union Bank off India Financial

You get to pertain on the web to express their demand for the fresh bank’s Home loan. Alternatively you can check out people Union Regional Things getting Merchandising Loans otherwise twigs in your vicinity. The application techniques are going to be broken up towards step three significant tips.

- Entry out-of a totally complete setting also the expected files.

- Analysis and you will sanction of the financing according to research by the recorded records.

- Disbursement after you have came across the partnership associated with the margin currency or any other blog post-approve formalities.

The complete processes and you may sanction of the mortgage takes as often as the 5 days day adopting the completion of paperwork.

Document Number to have Commitment Bank from Asia Financial

You must just remember that , record isnt exhaustive while the financial will get require even more records, with regards to the criteria.

- Salary slides the past 6 months.